India’s e-commerce market is a behemoth, a vibrant digital bazaar offering unparalleled convenience and choice. From groceries to gadgets, fashion to furniture, almost anything is just a click away. This digital gold rush, however, has a dark underbelly: online purchase fraud. As millions of new users embrace online shopping, often with varying levels of digital literacy, they become increasingly vulnerable to a sophisticated and ever-evolving array of scams designed to dupe them out of their hard-earned money. The convenience of the click can, for many, turn into a costly lesson in cyber-deception.

Online purchase fraud in India isn’t a monolithic entity; it’s a hydra with many heads, each employing different tactics to exploit unsuspecting consumers. Understanding these common modus operandi is the first line of defense.

The Many Faces of Online Purchase Fraud:

-

Non-Delivery of Goods: This is perhaps the most straightforward type. Fraudsters set up fake e-commerce websites or listings on genuine marketplaces, advertise attractive products at an even more attractive price, collect payment, and then simply vanish without delivering the item. The website might disappear, or customer service numbers become unresponsive.

-

Counterfeit or Substandard Products: A variation of non-delivery, here the consumer does receive a product, but it’s a far cry from what was advertised. It could be a cheap knock-off of a branded item, a refurbished product sold as new, or an item of significantly inferior quality. This is particularly rampant in categories like electronics, fashion apparel, and cosmetics.

-

Fake Websites and Apps: Scammers meticulously create websites or mobile applications that mimic legitimate, popular e-commerce platforms. They use similar logos, layouts, and branding to lull users into a false sense of security. Unsuspecting customers input their payment details, which are then stolen, or they pay for goods that never arrive. These fake sites are often promoted through social media ads, spam emails, or misleading search engine results.

-

Phishing and Vishing Scams:

-

Phishing: Fraudsters send emails or SMS messages pretending to be from reputable e-commerce companies, payment gateways, or delivery services. These messages often contain urgent calls to action – “Your account is suspended,” “Verify your payment details,” “Track your delayed package” – with links leading to fake login pages designed to steal credentials (usernames, passwords, credit card details).

-

Vishing (Voice Phishing): Scammers call victims, posing as customer care executives. They might claim there’s an issue with a recent order, a refund needs to be processed, or a KYC (Know Your Customer) update is required. They then trick the victim into revealing sensitive information like OTPs (One-Time Passwords), UPI PINs, or card details.

-

-

OTP/UPI Frauds: With the rise of Unified Payments Interface (UPI), new scam vectors have emerged. Fraudsters might send a UPI payment request instead of a payment, tricking the user into approving it. They might also call, pretending to process a refund, and guide the victim to enter their UPI PIN on a collect request, effectively authorizing a debit from their account. The infamous “QR code scam” involves tricking victims into scanning a QR code that, instead of facilitating a payment to them, debits money from their account.

-

Fake Customer Care Numbers: When users face issues with an online order, they often search for customer care numbers online. Scammers plant fake helpline numbers on unofficial websites or social media. When a distressed customer calls, the fraudster extracts sensitive information or tricks them into installing remote access software, gaining control of their device and bank accounts.

-

Triangulation Fraud: In this more complex scheme, a fraudster sets up a fake online storefront. When a customer places an order, the fraudster then uses stolen credit card details to purchase the same item from a legitimate retailer and has it shipped directly to the original customer. The customer receives their product, unaware that their payment went to the scammer and the legitimate retailer was defrauded using a stolen card. The original cardholder eventually disputes the charge, leaving the legitimate retailer out of pocket.

-

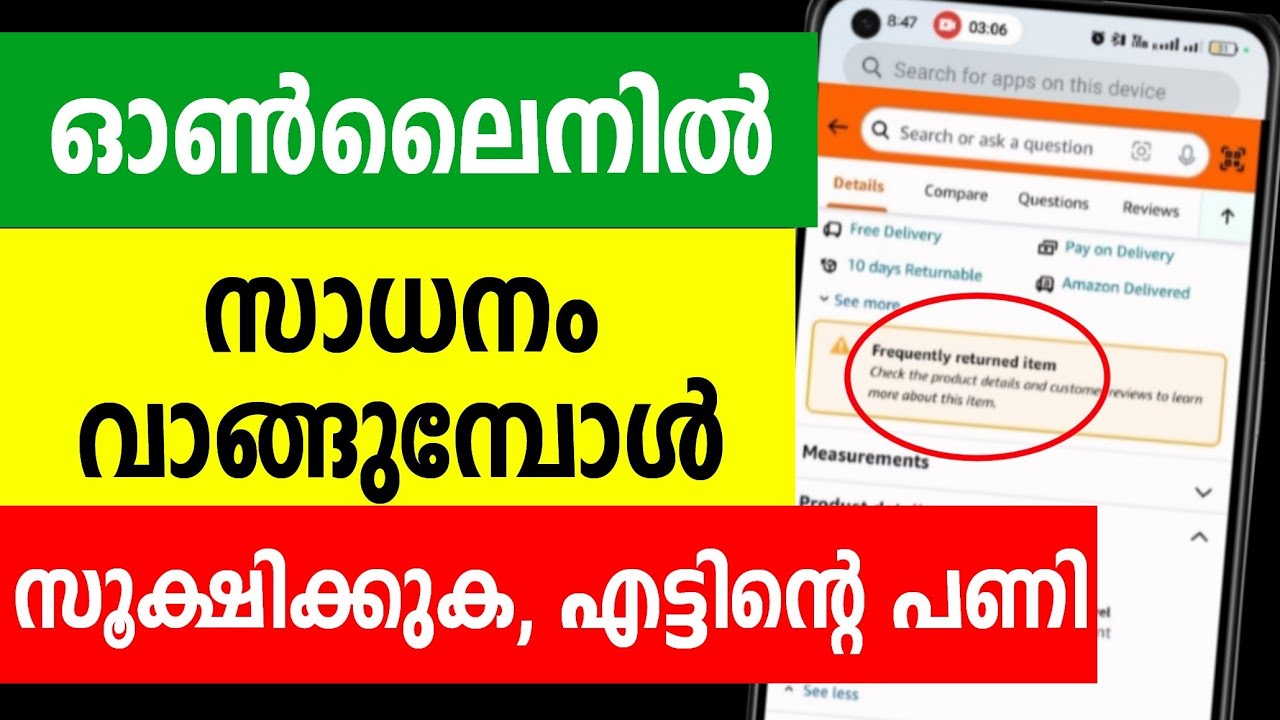

Fake Reviews and Inflated Ratings: While not direct financial fraud, this tactic misleads consumers into purchasing substandard products from dubious sellers, increasing the likelihood of other types of fraud or dissatisfaction.

Why is India a Hotbed for Online Purchase Frauds?

Several factors contribute to India’s vulnerability:

-

Rapid Digital Adoption: Millions are coming online for the first time, often lacking the digital literacy to identify sophisticated scams.

-

Sheer Volume: The massive user base makes it a numbers game for fraudsters – even a small percentage of successful scams can be highly lucrative.

-

Language Diversity: Scammers can exploit language barriers, creating phishing messages or fake websites in regional languages.

-

Trust in Authority Figures: Social engineering often plays on the inherent trust people have in figures they perceive as being from a bank or a reputable company.

-

Desire for Bargains: The allure of “too good to be true” deals can override caution.

-

Anonymity and Cross-Border Operations: Fraudsters can operate from anywhere, making them difficult to trace and prosecute.

-

Cash-on-Delivery (COD) Exploits: While COD is popular, some scams involve asking for advance partial payment for “customization” or “shipping insurance” for a COD order that never materializes.

The Ripple Effect: Impact Beyond Financial Loss

The impact of online purchase fraud extends far beyond the immediate financial loss to the victim. It causes:

-

Emotional Distress: Victims often feel violated, embarrassed, and helpless.

-

Erosion of Trust: It damages consumer confidence in the e-commerce ecosystem as a whole, potentially hindering its growth.

-

Damage to Legitimate Businesses: Reputable sellers can suffer reputational damage if their brand is impersonated or if consumers become overly wary.

-

Increased Operational Costs: E-commerce platforms and financial institutions have to invest heavily in fraud detection and prevention measures.

Combating the Scourge: A Multi-Pronged Approach

Tackling online purchase fraud requires a concerted effort from consumers, e-commerce platforms, financial institutions, and law enforcement agencies.

For Consumers: Vigilance is Key

-

Verify Website Authenticity: Look for “https://” and the padlock icon in the browser address bar. Be wary of websites with poorly designed interfaces, grammatical errors, or suspicious URLs.

-

Stick to Reputable Platforms: Prefer well-known e-commerce sites and their official apps.

-

Scrutinize Deals: If a deal seems too good to be true, it probably is.

-

Beware of Unsolicited Communication: Do not click on links or download attachments from unknown senders. Verify any urgent requests by contacting the company through official channels.

-

NEVER Share OTPs or PINs: No legitimate entity will ever ask for your OTP, UPI PIN, or credit card CVV over the phone or email.

-

Use Strong, Unique Passwords: Employ a password manager for different accounts and enable two-factor authentication (2FA) wherever possible.

-

Check Seller Reviews: But be aware that reviews can also be faked. Look for detailed, balanced reviews.

-

Monitor Bank Statements: Regularly review bank and credit card statements for any unauthorized transactions.

-

Prefer Credit Cards: Credit cards often offer better fraud protection and dispute resolution mechanisms than debit cards or direct bank transfers for online purchases.

-

Educate Yourself and Others: Stay informed about common scam tactics and share knowledge with family and friends.

Role of E-commerce Platforms and Authorities:

-

Robust Seller Verification: Platforms need stringent verification processes for sellers.

-

Advanced Fraud Detection: Implementing AI and machine learning tools to identify and flag suspicious activities and listings.

-

Clear Dispute Resolution: Providing efficient and fair mechanisms for resolving customer complaints.

-

Awareness Campaigns: Actively educating users about online safety.

-

Law Enforcement: Strengthening cybercrime cells, improving investigation capabilities, and ensuring swift prosecution of offenders. The National Cyber Crime Reporting Portal (cybercrime.gov.in) is a crucial resource for reporting.

-

Collaboration: Enhanced cooperation between banks, payment gateways, e-commerce companies, and law enforcement agencies is vital.

The Way Forward

Online purchase fraud is a dynamic challenge that will continue to evolve alongside technology. While the convenience of e-commerce is undeniable, it comes with inherent risks. A digitally savvy and vigilant consumer base, coupled with proactive measures from businesses and robust enforcement by authorities, is India’s best defense against these silent digital thieves. The goal is not to shy away from the digital marketplace, but to navigate it with caution, knowledge, and a healthy dose of skepticism, ensuring that the click leads to satisfaction, not sorrow.